Tax Big Data

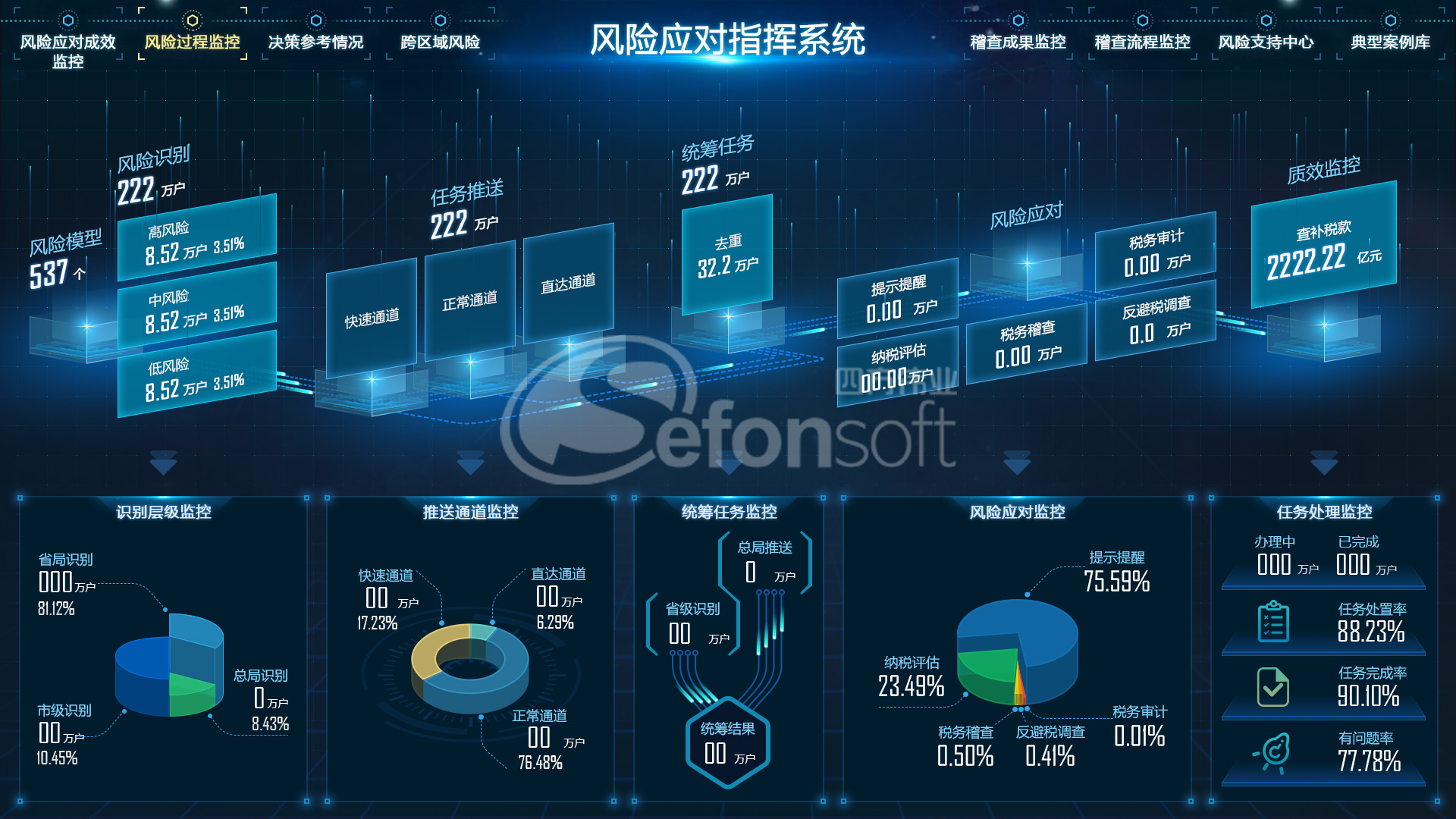

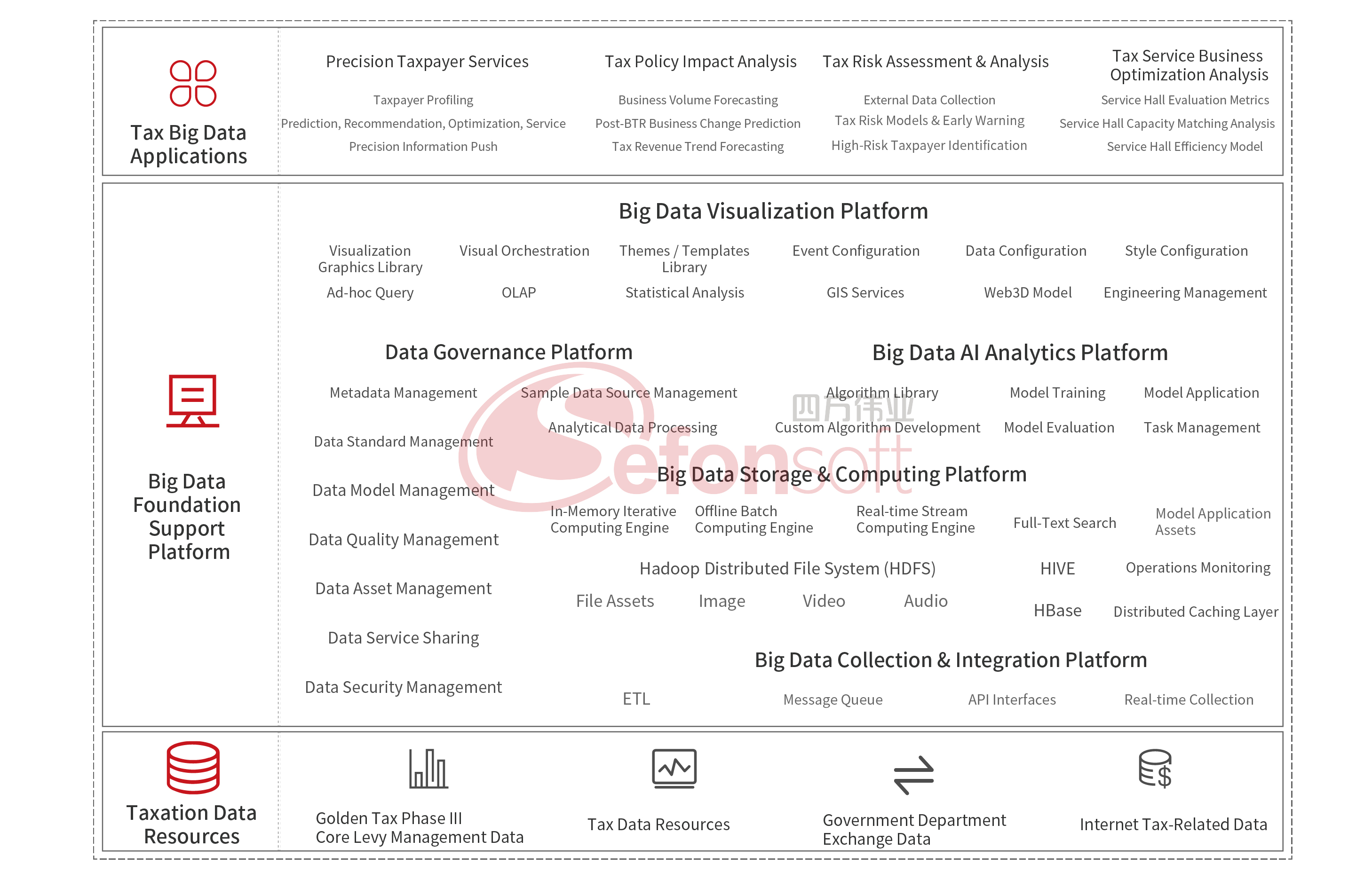

Tax administration is increasingly moving toward precision, intelligence, and scientific management through big data technologies. Tax authorities are exploring the use of informatization tools to integrate big data into tax governance, continuously improving the tax governance system, optimizing governance methods, and launching a series of innovative service initiatives. These efforts not only facilitate taxpayers but also further enhance the efficiency and effectiveness of tax collection and administration.

Copyright ©Chengdu Sefon Software Co.,Ltd.

蜀ICP备14024109号

Copyright ©Chengdu Sefon Software Co.,Ltd.

蜀ICP备14024109号